John Smith wrote on Jan 30

th, 2015 at 7:12pm:

7 yrs is a long term average, not a rule

JS,

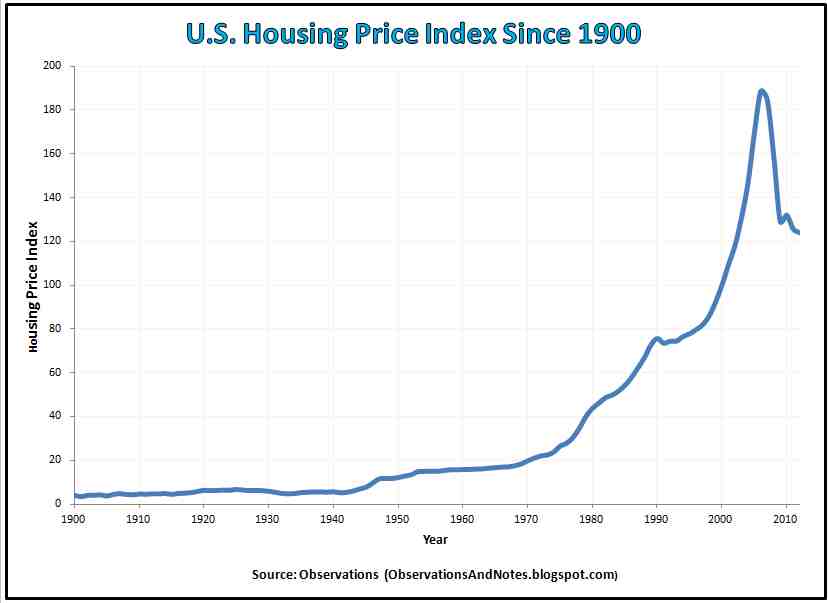

I think you may find that the OZ experience is not dissimilar to the US example, on the following chart.

Let's leave aside the recent US dip in Prices for a moment & look at the other 2 basic periods -

1) 1990-1945: not really much growth, certainly nowhere near 10% P/A.

2) 1945-2006: the market slowly started to lift after WW2 & really started to motor along around 1970, perhaps around 8-9%.

So, doubling every 7 years may be a little high, but not that far off the mark, for the US & the OZ market may have been a little better?

But, that is for a "relatively short" 36 years or so.

Anyway, my point is that the OZ market of the last 40 or so years, won't be repeated over the next 40 years! In fact, we will most likely follow the US, Japan & Europe trends, with a Decline in Housing value, which I suspect will start about now.

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages: 1

Pages: 1