Demographics Point To A Bear Market For The Next 5 Years

SummaryThe market volatility we've seen is indicative of an inflection point between a bull and a bear market.

This bear market will last at least 5 years as Baby Boomers divest and Millennials lack financial resources to invest.

We'll see an unusual conjunction between growth and value in stocks.

Guarding against inflation will be more important than keeping the market afloat.

"Demographics explain everything", to paraphrase University of Toronto professor David Foot in his book, Boom, Bust & Echo.

The FactsLet's start by laying out the facts vital to this hypothesis.

Baby boomers born from 1946-1964 are currently 54 to 72 years old (as of the end of 2018).

Generation Xers aged 38 to 53 were born between 1965-1980.

Millennials born between 1981-1996 are aged 22-37 currently.

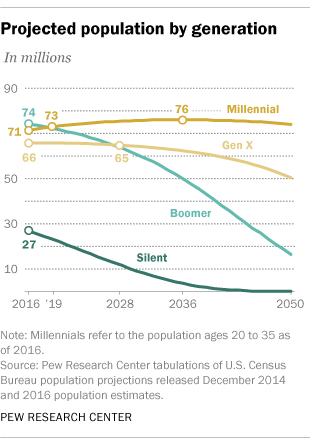

The ProjectionsAccording to Pew Research, Millennials will surpass Baby Boomers as the largest cohort in 2019.

However, Baby Boomers will continue to be the dominant generation from a political perspective for at least the next five years - they still own most of the assets, hold the top jobs and positions of political power. They've also experienced advocates for getting what they want.

As they move into retirement, more than a strong stock market (which was very important to them as they accumulated and grew their assets), they will want low inflation. There is nothing more frightful to a person on a fixed income than rising prices.

They'll also want a strong dollar, as it'll enhance their retirement years, not the least of which is through the ability to travel. But the threat of loss is the greater motivator, so low inflation will be their greatest concern.

The central banks in both countries will begin to shift their decision criteria from a strong stock market and even a strong economy to low inflation. Perhaps all three can co-exist peacefully as we've experienced recently, but if it comes down to a choice, fighting inflation will win.

Which, of course, means that there's an increased probability of rising interest rates and an end to loose monetary policies.

However, even without rising interest rates, the stock market will soften. Boomers will begin to make net reductions in their financial asset purchases and indeed will begin to sell them.

They will transition their portfolio from growth assets into income and safety - bonds and dividends. Although a falling stock market can be painful, it's not entirely without benefit. Lower stock prices mean better dividend yields for retirees. Higher interest rates also mean better bond yields.

Financial asset purchases for Millennials will also slow down as they enter into the housing market and begin raising families.

The only people making net financial assets purchases will be Generation X. Growth stocks, an asset they would normally favor in this period of their life cycle will be unpopular and hence cheap. There'll be an unusual merger of value and growth during this time, and evidence of this is already emerging in the falling prices for M-FANNG type stocks.

Baby Boomers will also downsize. They'll sell their larger homes and buy smaller ones and condos. Of course, this is the same size that first time home buying Millennials will want too. I'm forecasting firm prices in smaller homes, but softer prices in larger ones. A situation that will favor Generation X.

In approximately 5 to 10 years, the political power of Boomers will be noticeably waning and Millennials will begin their ascent. This will also be coupled with increased ability to invest.

What will Millennials want? Bigger homes, easier credit, and rising stock prices. The start of a new credit cycle and bull market.

====================================

There are actually a FEW MAJORS influencing Factors -

1) Demographics

2) Energy

3) Climate Change

AND, what arises from these in terms of Demand (or lack of) & Debt!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: