Demographic Trends

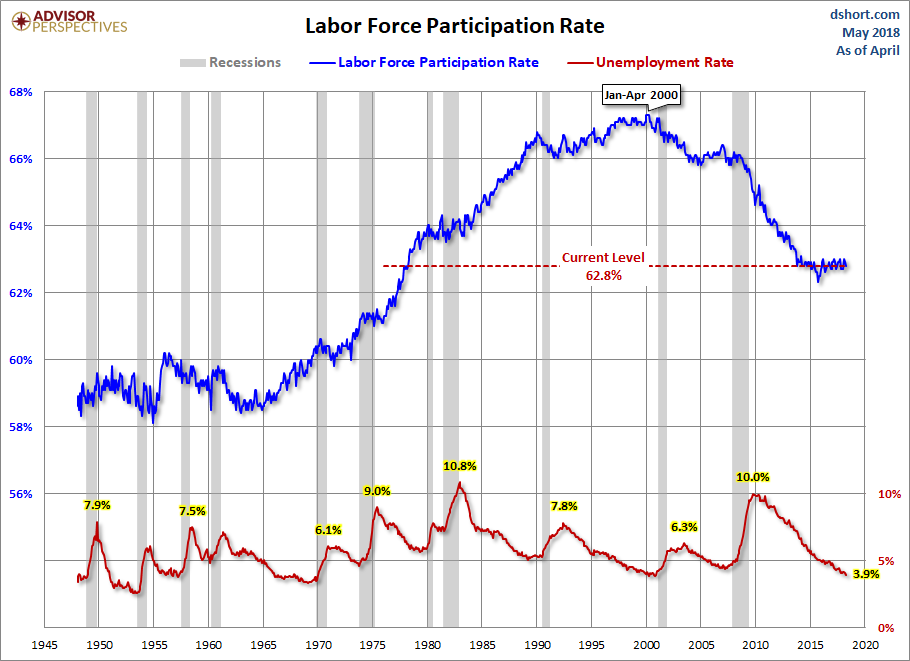

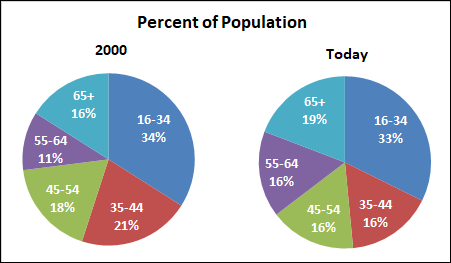

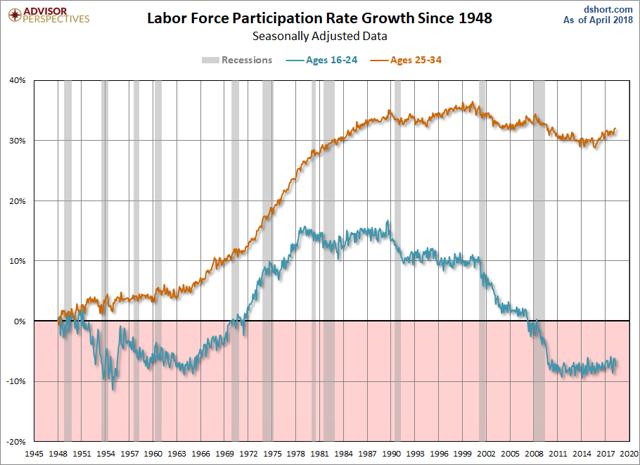

The overall LFPR peaked in early 2000 at 67.3% and gradually began falling. The rate leveled out from 2004 to 2007, but in 2008, with the onset of the Great Recession, the rate began to accelerate. The latest rate is 62.8%, off its interim low of 62.4%. The demography of our aging workforce has been a major contributor to this trend.

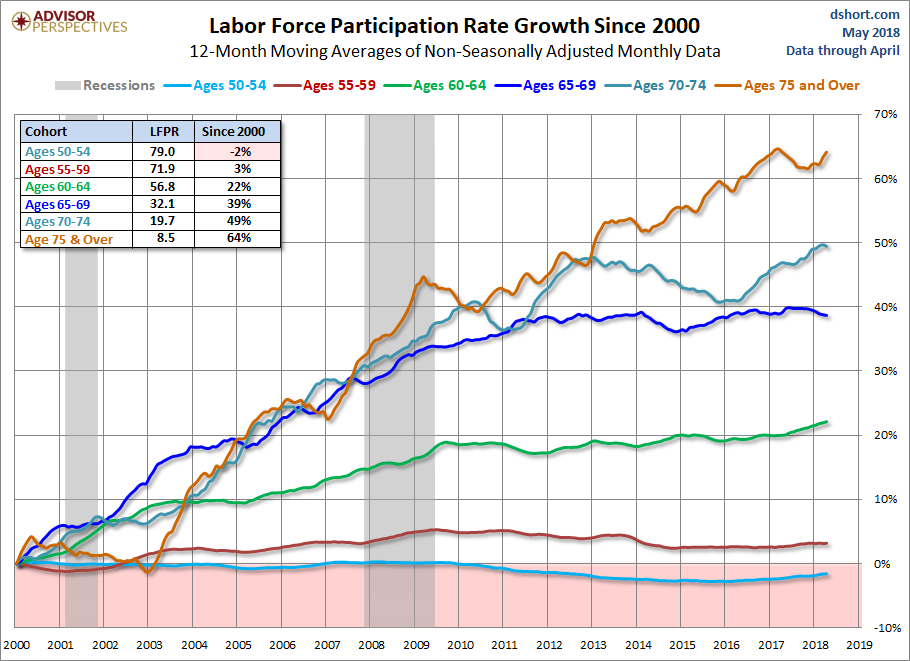

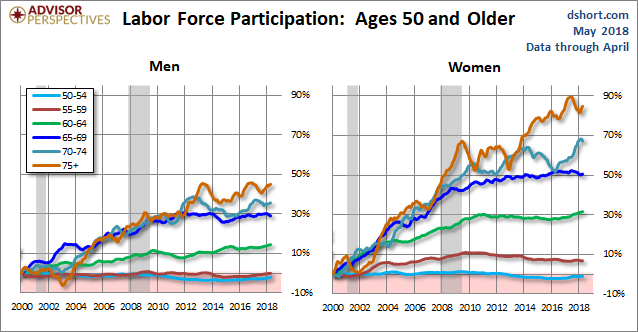

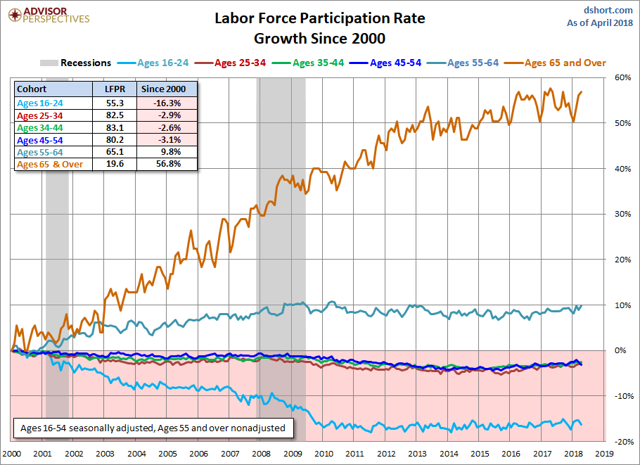

The Growing Ratios Of Older WorkersThe pattern is clear: The older the cohort, the greater the growth.

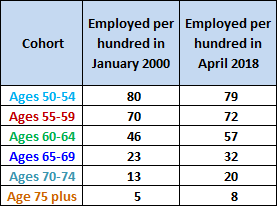

Another Way To Envision The Data

Another Way To Envision The Data

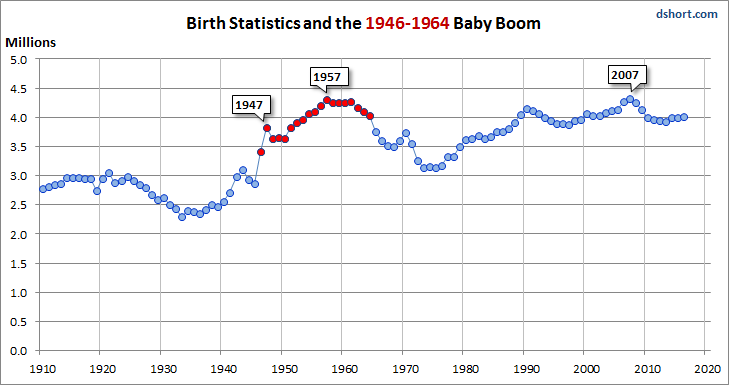

There is no question that the pace of Boomer retirement will accelerate in the years ahead. Just add about 65 years to the red dots in the chart below and you'll get some idea of the epic retirement wave that is just beginning (and note that the birth statistics below don't include immigration).

The Gender Difference

The Gender DifferenceThe comparative growth in the 50+ cohorts by gender is rather amazing. The LFPR for Women Age 75 and Over has risen about 85% since the turn of the century. The rate for Men Age 75 and Over is up less than half the Women's rate around 45%.

https://seekingalpha.com/article/4171629-demographic-trends-50-older-work-force?...

https://seekingalpha.com/article/4171629-demographic-trends-50-older-work-force?...==================================

Aging Baby Boomers: Implications For Munis

By 2035, the elderly will outnumber young people for the first time in American history.

State Pension Budget PinchIt is simple math: with a shrinking proportion of working-age adults-to-retirees, there may simply not be enough revenue to support the generous pensions that many states' defined benefit plans have promised, the unfunded liabilities of which already stood at some $574 billion as of 2011.

This will probably necessitate a reduction in services, an increase in taxes, pension reforms, or some combination of the three.

As state governments grapple with unfunded pension liabilities, local governments may need to raise property taxes to generate additional revenue as they are forced to shoulder an increasingly high share of the cost of delivering essential services to residents.

Looming Healthcare GapsMuch has been made of the looming funding gaps facing Social Security and Medicare, and rightfully so, as demographic trends point to an eye-popping $100 trillion shortfall in funding for these federal programs over the coming decades.

Education SqueezeWhat happens to education funding when state budgets are squeezed by ballooning Medicaid costs and unfunded pension obligations on a historic scale?

https://seekingalpha.com/article/4171634-aging-baby-boomers-implications-munis?i...==================================

Millennials And The Labor Force: A Look At The Trends

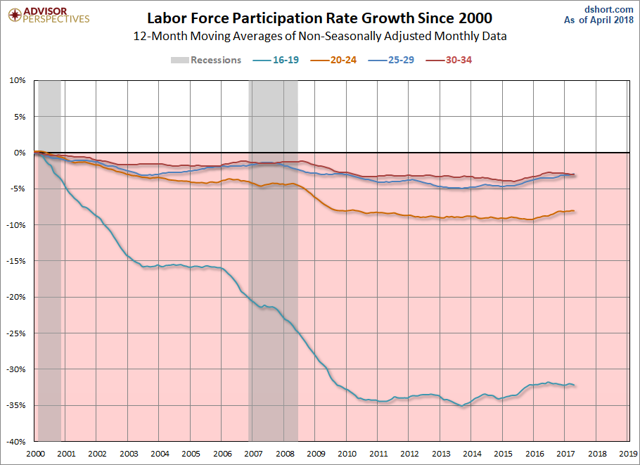

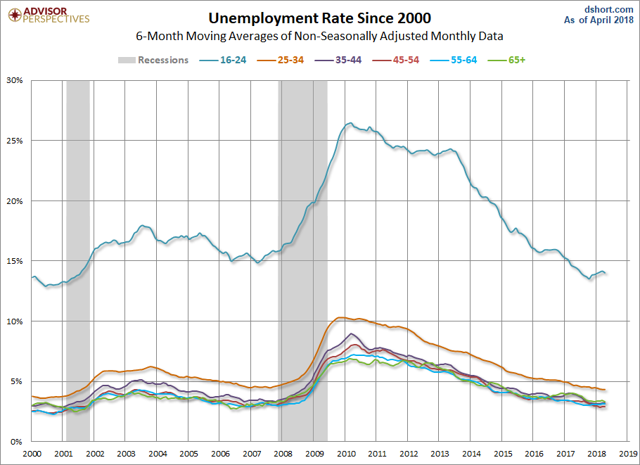

Millennials make up the largest percentage of our population today, yet have seen some of the lowest labor force participation growth and highest unemployment out of all age groups since the turn of the century. This has larger implications when coupled with slow wage growth, high home prices, and mounting student debt.

Here is a comparison of the five cohorts since the turn of the century.

https://seekingalpha.com/article/4172131-millennials-labor-force-look-trends?ifp...

https://seekingalpha.com/article/4172131-millennials-labor-force-look-trends?ifp...====================================

As discussed previously, THE 3 PRIMARY ECONOMIC DRIVERS -

1) Population - Slowing Global Growth & Aging.

2) Energy - Global Supply & Pricing.

3) Global Climate Change - Likely to further Adversely affect our capacity, for an increasing Population.

AND Yes, "this time is Different", in Cause, Effect & Duration!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: