The Pension Crisis Is Worse Than You Think

"

Today, the hard stop is five to 10 years away, within the career plans of current officials. In the next decade, and probably within five years,

some large states are going to face insolvency due to pensions, absent major changes.The next phase of public pension reform will likely be touched off by a stock market decline that creates the real possibility of at least one state fund running out of cash within a couple of years.

The math says that tax increases and spending cuts cannot do much."

But the problem is not just in the United States but the mismanagement of assets, combined with irrational and flawed return expectations, has spread globally."

According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…The WEF says the deficit is growing by $28 billion every 24 hours -

and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today."

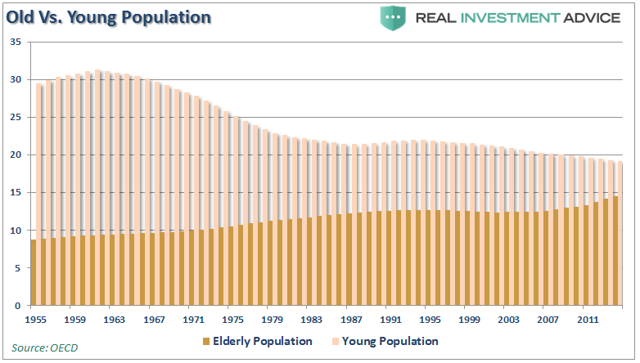

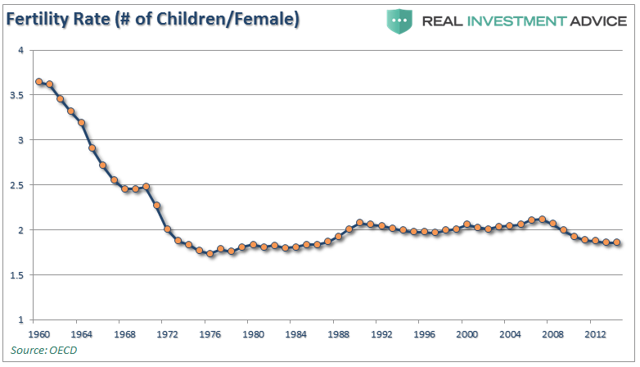

While we all want to ignore the problem, it isn't going away. More importantly, there is nothing that can, or will, change the two primary problems fueling the crisis.Problem #1: DemographicsOne of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.) However, this

"support ratio" is not only declining in the U.S. but also in much of the developed world.

This is due to two demographic factors: increased life expectancy, coupled with a fixed retirement age, and a decrease in the fertility rate.

In 1950, there were 7.2 people aged 20-64 for every person of 65 or over in the OECD countries. By 1980, the support ratio dropped to 5.1, and by 2010, it was 4.1.

It is projected to reach just 2.1 by 2050.Problem #2: Markets Don't CompoundThe biggest problem, however, is the continually perpetrated "lie" that markets compound over time. Pension computations are performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables.

The biggest problem, following two major bear markets, and sub-par annualized returns since the turn of the century, is the expected investment return rate.By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.Pensions STILL have annual investment return assumptions ranging between 7% and 8% even after years of underperformance.

However, the reason assumptions remain high is simple.

If these rates were lowered 1-2 percentage points, the required pension contributions from salaries, or via taxation, would increase dramatically. For each point reduction in the assumed rate of return would require roughly a 10% increase in contributions.Therefore, pension managers are pushed to sustain better-than-market return assumptions which requires them to take on more risk.

But therein lies the problem.Given real-world return assumptions,

pension funds SHOULD lower their return estimates to roughly 3-4% in order to potentially meet future obligations and maintain some solvency.They won't make such reforms because "plan participants" won't let them. Why? Because:

1.

It would require a 40% increase in contributions by plan participants which they simply cannot afford.2. Given that many plan participants will retire LONG before 2060,

there simply isn't enough time to solve the issues, and;

3.

The next bear market, as shown, will devastate the plans abilities to meet future obligations without massive reforms immediately.

We Are Out Of TimeCurrently, 75.4 million Baby Boomers in America - about 26% of the U.S. population - have reached or will reach retirement age between 2011 and 2030. And many of them are public sector employees. In a 2015 study of public sector organizations,

nearly half of the responding organizations stated that they could lose 20% or more of their employees to retirement within the next five years.If the numbers above are right, the unfunded obligations of approximately $4-$5.6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program's shortfall between tax revenues and payouts over the next 75 years.

That isn't going to happen.It's an unsolvable problem. It will happen.https://seekingalpha.com/article/4166196-pension-crisis-worse-think?ifp=0

=================================

The are 3 "Ultimate issues" driving current Economic Events -

1) Population

2) Energy

3) Climate Change

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: