EIA World Crude Oil Production

The EIA has apparently stopped publishing its International Energy Statistics. Instead they are now publishing an abbreviated version on their Total Energy web page titled: Tabel 11.1b World Crude Oil Production. Here they publish crude + condensate production numbers for Persian Gulf Nations, Selected Non-OPEC Countries, Total Non-OPEC and World. The "Selected Non-OPEC Producers" are Canada, China, Egypt, Mexico, Norway, Russia, United Kingdom and the United States. They have just released their latest data through February 2016.

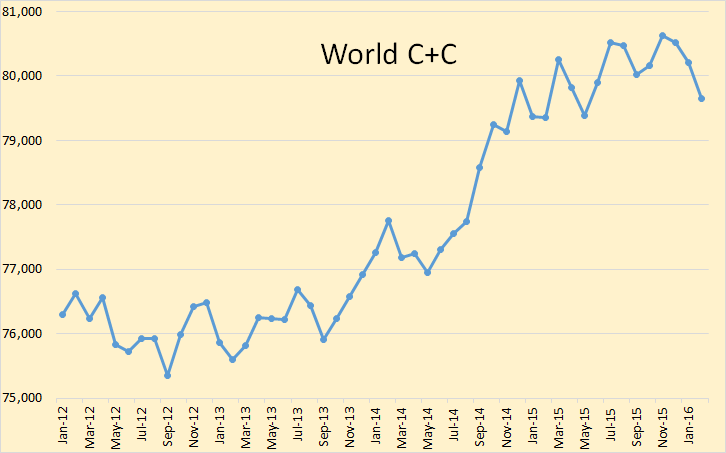

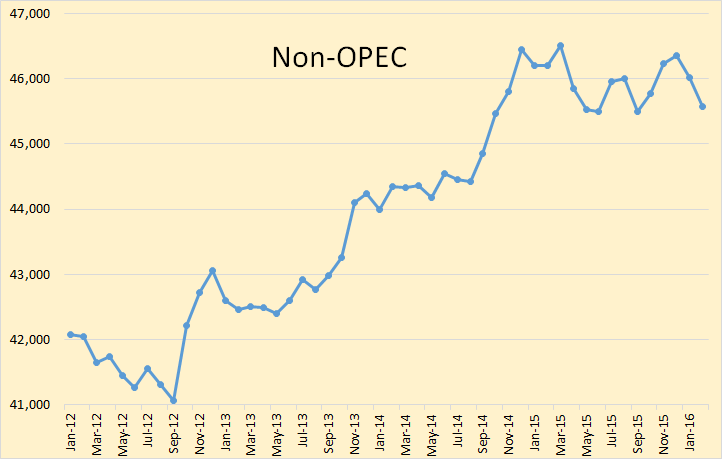

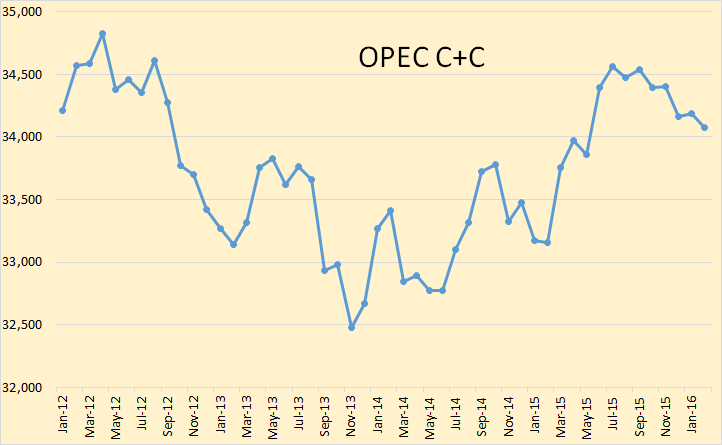

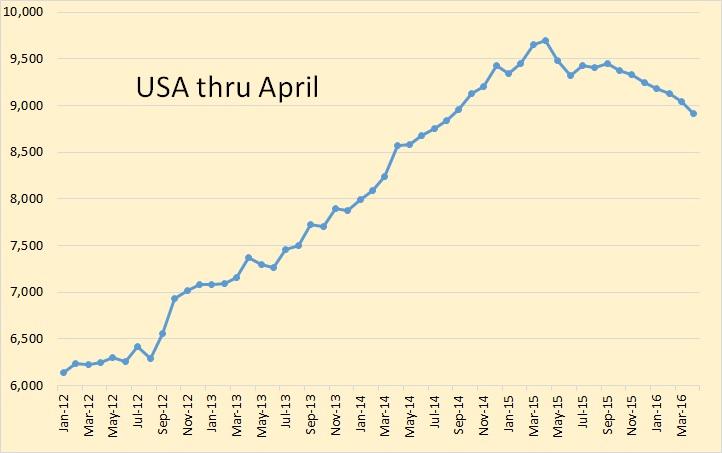

All the data below is in thousand barrels per day and through February 2016 unless otherwise noted.

They have world C+C peaking, so far, in November 2015 at 80,630,000 bpd. February production was 79,653,000 bpd or 977,000 bpd below the peak.

They have Non-OPEC peaking in March 2015 at 46,504,000 bpd and down by 925,000 bpd in February to 45,579,000 bpd.

They do not publish the OPEC C+C numbers but it is easy enough just to subtract the Non-OPEC data from the World data and get the data. OPEC C+C failed to breach its 2012 peak but did reach 34,562,000 bpd in July 2015, but by February 2016 it was down 488,000 bpd to 34,074,000 bpd.

China has peaked. The only question left to be answered is how fast will she decline?

Mexico managed to stem their decline for a few months but their production has begun to decline again.

Russia has been a real shocker. No one, inside or outside Russia, expected them to increase production by over 200,000 bpd over the last few months.

The USA is, of course a big part of what is happening to world oil production, and will continue to play a big part. I think US production will continue to decline for another year or so. After that? I think production will flatten out then increase slightly. But the boom times very expensive shale oil brought are over.

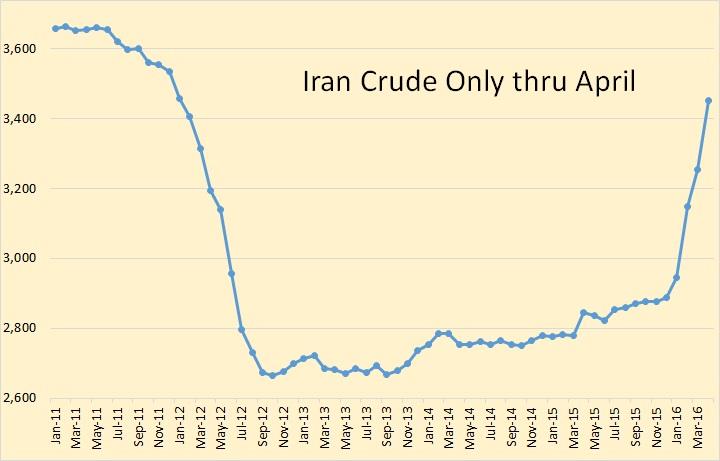

Iran is the main reason the price induced decline has not become obvious.

In conclusion: In spite of the recent increase in Russian production as well as the slight increase from the North Sea, in spite of the dramatic production increase from Iran due to the lifting of sanctions, world crude oil production is in decline. But… the decline has only just begun. The price collapse caused the plateau in world oil production that began about March 2015. However, the decline did not actually begin until January 2016. The dramatic rise in production from Iran has kept the decline from becoming obvious to everyone. However, when the May production numbers come in, I think it will then become obvious to everyone.

http://seekingalpha.com/article/3978668-eia-world-crude-oil-production?ifp=0===================================

It all about Demand & Supply!

Demand has already started to come off the boil & Supply is in the process of doing the same!

There will no doubt, be UPS & DOWNS, in both Supply & Demand, But the Longer Term Trend, will finally show a DOWNTURN IN BOTH DEMAND FOR & THE SUPPLY OF, OIL and that will have ramifications, which will intermix with the other MAJOR ECONOMIC INFLUENCERS, including DEMOGRAPHICS, CLIMATE CHANGE & DEBT!!!

Oh & Btw, I wouldn't think it is co-incidental that the EIA has decided to stop publishing since 2014, in the previous format!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: