Collapse Of Shale Gas Production Has Begun

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun.All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

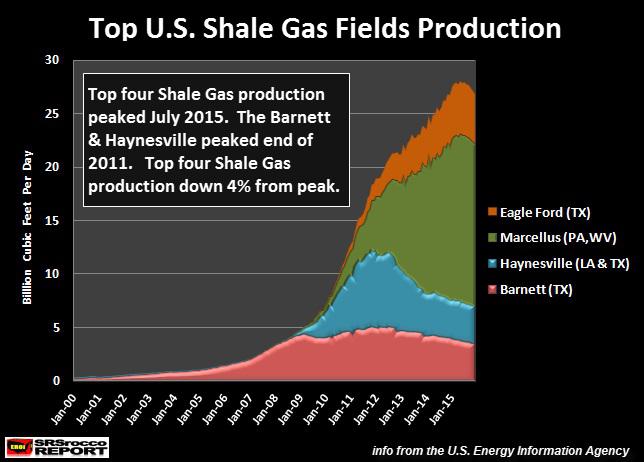

The Great U.S. Shale Gas Boom Is Likely Over For GoodTotal shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

Basically, the overwhelming majority of the shale gas extracted at the Haynesville was done so at a complete loss.

Chesapeake is one of the larger shale gas producers in the Haynesville as well as in the United States. According to its recent financial reports, Chesapeake received $1.05 billion in operating cash in the first three-quarters of 2015, but spent $3.2 on capital expenditures to continue drilling. Thus, its free cash flow was a negative $2.1 billion in the first nine months of 2015. And this doesn't include what it paid out in dividends.

The reason these companies continue to produce shale gas at a loss is to keep generating revenue and cash flow to service their debt. If they cut back significantly on drilling activity, their production would plummet. This would cause cash flow to drop like a rock, including their stock price, and they would go bankrupt as they couldn't continue servicing their debt.

Basically, the U.S. Shale Gas Industry is nothing more than a Ponzi Scheme.

While the collapse of U.S. shale gas production is one nail in the U.S. Empire Coffin, the other is Shale Oil. U.S. shale oil production peaked before shale gas production: The notion of U.S. energy independence was built on hype, hope and cow excrement. Instead, we are now going to witness the collapse of U.S. shale oil and gas production.

The notion of U.S. energy independence was built on hype, hope and cow excrement. Instead, we are now going to witness the collapse of U.S. shale oil and gas production.The collapse of U.S. shale oil and gas production are two nails in the U.S. Empire coffin. Why? Because U.S. will have to rely on growing oil and gas imports in the future as the strength and faith of the Dollar weakens.

I see a time when oil exporting countries will no longer take Dollars or U.S. Treasuries for oil. Which means… we are going to have to actually trade something of real value other than paper promises.I believe U.S. oil production will decline 30-40% from its peak (9.6 million barrels per day July 2015) by 2020 and 60-75% by 2025

. The U.S. Empire is a suburban sprawl economy that needs a lot of oil to keep trains, trucks and cars moving.

A collapse in oil production will also mean a collapse of economic activity.

Thus, a collapse of economic activity means skyrocketing debt defaults, massive bankruptcies and plunging tax revenue. This will be a disaster for the U.S. Empire.

http://seekingalpha.com/article/3851316-collapse-shale-gas-production-begun?ifp=...==============================================

This article is especially for Longy/Maria, who are still "true believers", in Shale Oil/Gas, that there is nothing different happening now, that the good old times will roll again & that it's all just part of "the cycle"!?And, as usual, Longy/Maris

areis wrong, yet again!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: