Is Finland's Economy Suffering From Secular Stagnation? (Cont)

What To Do About The Situation?The whole topic of secular stagnation is a highly controversial one at the present time. In the first place there is no general agreement that this is what is affecting a country like Finland. Those, like Prime Minister Alexander Stubb would argue that it is simply a question of the country having lived beyond its means, and hence lost competitiveness.

Thus, in his opinion, what it now needs is a lengthy process of internal devaluation and austerity. Curiously - in a country that was busy recommending sharp austerity to others - he blames rising debt and lax fiscal policies for the situation. Finland's economy could flat-line through the 2020s, he suggests, if politicians fail to curb taxes and government debt.

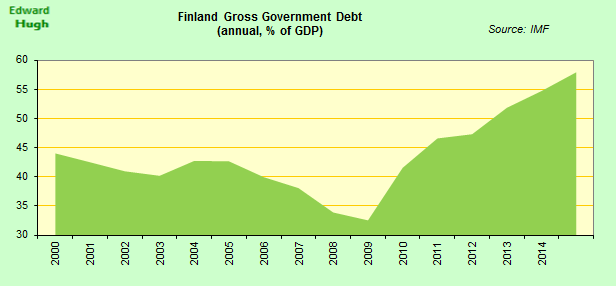

The government debt of Finland has almost doubled since 2008, from 28 percent of gross domestic product to 48 percent at the end of 2014. Taxes have risen 3 percentage points over the same period as different administrations tried to preserve benefits without resorting to deep cuts. The jobless rate this year will rise slightly to over 9.1 percent, the government estimates. GDP languishes below its 2008 level - Bloomberg News.

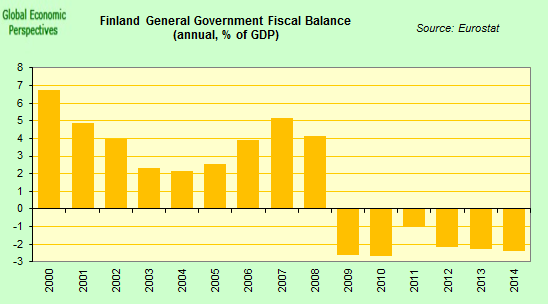

Certainly, having not adequately analyzed what was happening, the country has been running a series of fiscal deficits which continued beyond the crisis as the momentum provided by the housing boom has waned.

Naturally, with no growth and low inflation the government debt level has been rising rapidly. The level is still low - the IMF forecast it will hit the 60% of GDP EU limit this year - but if it continues rising at this rate it won't stay low for long.

So, what do you do about the problem of secular stagnation, if that is what it is? Again, here there is divergence of opinion. Some still seek to treat the phenomenon as if it were a variant of the liquidity trap issue. Most notably Paul Krugman, who continues to hope that massive quantitative easing backed by strong fiscal stimulus will push economies like the Finnish one back onto a healthy path. But if the issue is secular stagnation, and the root is population aging and shrinking, it is hard to see how this can be.

The fact that Japan is just about to fall back into deflation 2 years after applying a monumental Quantitative Easing problem seems to endorse the idea that the problem may have no "solution" in the classical sense of the term.

Is There A Temporary "Free Lunch"Nothing ever comes entirely free, and one of the issues which arises with permanent QE is that it may be applied only at the cost of generating bubble type problems elsewhere, an issue which I look at in Secular Stagnation - On Bubble Business Bound. But developed economies are in a bind, and they do need to find some path to move forward along.

At the end of the day, only two things can be said with a fair degree of certainty: short term fiscal austerity won't make any significant improvement to Finland's situation, and it could help make things worse (this whole discourse is based on a misunderstanding about what the problem is) while, on the other hand, what short term stimulus won't do is stimulate.Structural reforms - aimed to increase labour market participation rates, and extend working lives - can help. So can measures to improve the quality of education, and the effectiveness of investment into new technologies. But if we look at Japan, even these offer no simple panacea.

Finnish society, like many other European ones, is in the throes of a major transition. More debate needs to be held on what to do to facilitate the transition, and in the meantime deficit spending to make investments in future productivity improvements seems not to be a bad idea. Running deficits in order not to change, in contrast, would be.

http://seekingalpha.com/article/3035846-is-finlands-economy-suffering-from-secul...=========================================================

Whilst there are some variations, you may recognize SOME similarities?

The overriding issue is that change on a massive scale is impacting the Global Economy & the "old fixes" simply won't work anymore!

We should have started changing policy/s 40-50 years ago, to make way for what is now happening, BUT WE DIDN'T, so now change will be forced, much quicker than it should have been & most likely much more unpalatable!

That said, IF the change/s are not "fairly spread", then they won't work, they will only make matters worse!

So, I would suggest the following, for starters -

1) Removal of a large number of TAX/Expenditure RORTS.

2) The imposition of Higher, not Lower Taxes, on both Business (up to say 32%, not down to 28.5%) & Individuals (Raise by 2-3% for all levels).

3) Raise GST to 12.5% & make it applicable to pretty much everything.

The time has long since gone, when we can "pretend" there is no problem &/or that the other Political Party are the problem.

Both major Political Party's have been & are the problem, because they didn't take appropriate action/s over the last 40 to 50 years, the problems are here now & we need to act now!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: