The Keynesian End Game Crystalizes In Japan's Monetary Madness

If the BOJ’s mad money printers were treated as monetary pariahs by the rest of the world, it would at least imply that a modicum of sanity remains on the planet. But just the opposite is the case. Establishment institutions like the IMF, the US treasury and the other major central banks urge them on, while the Keynesian arson squad led by Professor Krugman actually faults Japan for being too tepid with its “stimulus”.

Now comes several new data points that absolutely confirm Japan is a financial mad house—-even as its policy model is embraced by mainstream officials and analysts peering from a distance. Front and center is the newly reported fact from the Cabinet Office that Japan’s household savings rate plunged to minus 1.3% in the most recent fiscal year

During the era before it’s plunge into bubble finance in the late 1980s, households routinely saved 15-25% of income. But after nearly three decades of Keynesian policies, Japan has now stumbled into an insuperable demographic/financial trap; and one that is unusually transparent and rigidly delineated, to boot.

Since Japan famously and doggedly refuses to accept immigrants, its long-term demographics are rigidly baked into the cake. Accordingly, anyone who will make a difference over the next several decades has already been born, counted, factored and attrited into the projections.

Japan’s work force of 80 million will thus drop to 40 million by 2060. At the same time, its current 30 million retires will continue to rise, meaning that its retiree rolls will ultimately exceed the number of workers.

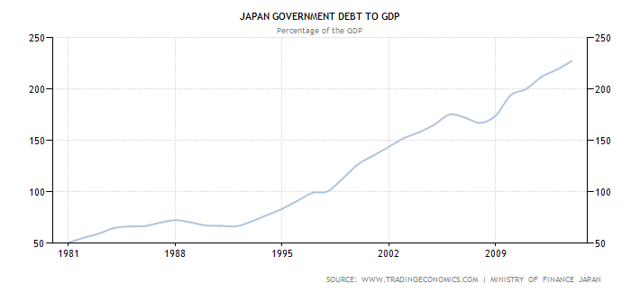

Given those daunting facts, it follows that on the eve of its demographic bust Japan needs high savings and generous interest rates to augment retirement nest eggs; a strong exchange rate to attract foreign capital to help absorb its staggering $12 trillion of public debt, which already stands at a world leading 230% of GDP; and rising real incomes in order to shoulder the heavy taxation that is unavoidably necessary to close its fiscal gap and contain its mushrooming public debt.

Needless to say, this radical monetization of the entire government bond market is an act of financial suicide. Yet 40% of Japan’s government revenue is already absorbed by servicing its gargantuan public debt. Even a 180 basis point increase in average yields (meaning that the 10-year JGB would still be under 2%) would absorb the remainder. That’s right, 100% of government revenue would be pre-empted by debt service.

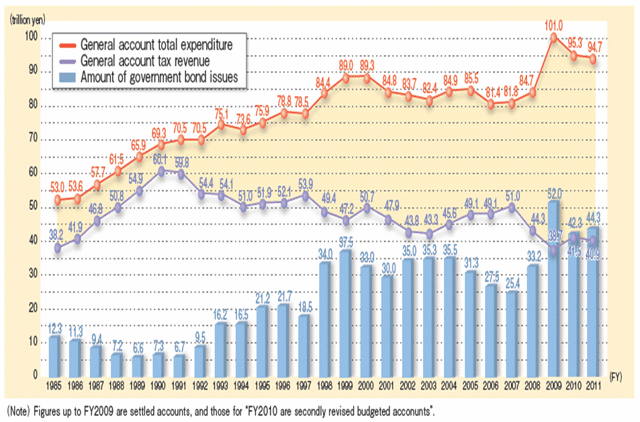

Even after the consumption tax increase from 5% to 8%, Japan’s general government is spending about 100 trillion yen per year while obtaining only 50 trillion yen in tax revenue.

Now, having wasted 25 years figuratively building highways and bridges to nowhere, the Abe government has obtained a mandate not to raise taxes further until at least 2017. This means that the public debt will continue to soar, and that the BOJ will be under unrelenting pressure to monetize 100% of the new debt issues, least it risk a devastating flare-up in yields.

Since the early 1990’s Japanese bond yields have been falling owing to the BOJ’s financial repression, supplemented by the disinflationary boom stimulated on a worldwide basis by central bank fueled credit expansion. For all practical purposes, Japan’s government debt yields are at the zero bound, and, in fact, maturities up to two years are trading at negative yields.

By the same token, the public debt burden has been climbing relentlessly since the early 1980s owing to the embrace of Keynesian fiscal policies, as so vividly demonstrated in the graph above. And now owing to Abenomics, another 7-10% of GDP will be added annually to the public debt in the years just ahead.

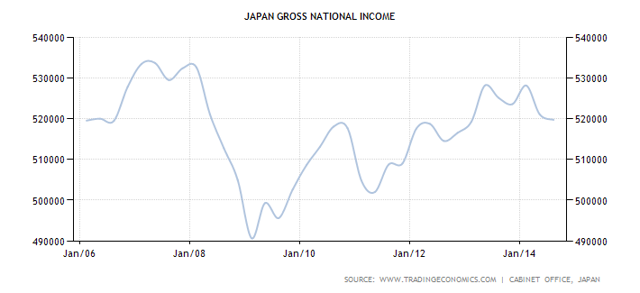

The desperate nature of Japan’s debt trap could not be more vividly depicted than in the chart below. In yen terms—-and that’s the metric that drives Japan’s budget receipts—–national income has not experienced any net growth since 2006! And Abenomics has not altered the picture in the slightest.

So for the moment at least, Japan has resorted to 100% printing press finance of its public accounts.

But here’s the thing. The BOJ is destroying the yen and absolutely foreclosing the option of international capital inflows in the years ahead

Thus, the Keynesian disaster is complete.

http://seekingalpha.com/article/2786145-the-keynesian-end-game-crystalizes-in-ja...======================================================

1) If only Japan hadn't had Leftist Governments, they would be ok now?

Well, Japan actually had "Conservative" or Centrist governments, for the period since 1990!

2) It wouldn't have made any difference, IF Leftists had been in power.

3) If Japan had taken the Austrian approach, then their Economy would have Declined further & Faster!

4) Japan is the Canary in the Demographic Coal Mine!

Forum

Forum

Home

Home

Album

Album

Help

Help

Search

Search

Recent

Recent

Rules

Rules

Login

Login

Register

Register

Pages:

Pages: